The course will help students understand the basic aspects of Banking and Insurance. The course has included the significant changes that have taken place in the global financial architecture and technology that are used in this sector.

In this 3 year undergraduate programme students will learn about the core subjects like Financial Accounting, Business Economics, etc along with some specialised courses like Business Taxation, Indian Banking System, in the area of Banking and Finance.

A BBA in Insurance & Banking is a graduate’s entry into this rapidly growing sector, where they will bw able to explore various job opportunities in investment banking, treasury and forex banking, as well as all other areas of insurance.

| BBA Banking and Insurance Course Overview | |||

|---|---|---|---|

| Course Level | Undergraduate | ||

| Duration | 3 years | ||

| Eligibility | 10+2 from any recognized board | ||

| Entrance Exams | CAT/ XMAT/ SNAP/GMAT/CMAT, etc | ||

| Subjects | Retail Banking, Principles of Insurance, Marketing in Banking & Insurance, etc | ||

| Course fee | 2-4 LPA | ||

| Job Profile | Credit and Risk Manager, Insurance Manager, Asset Manager, etc | ||

| Leading Recruiters | IBM, INNOWAR, HDFC Bank, Fidelity, etc | ||

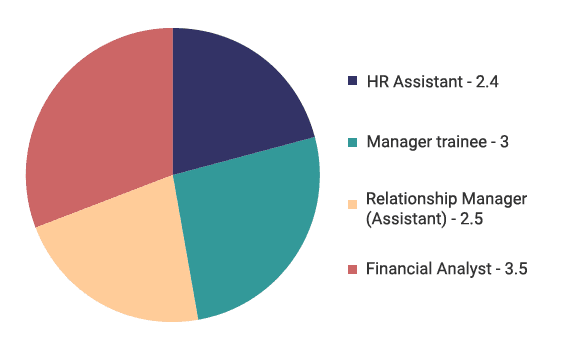

| Salary Package | 2.5-4 lacs PA | ||

| BBA Banking and Insurance Syllabus | |||

|---|---|---|---|

| Business Accounting | Advertising and Sales | ||

| Language | Organizational Behaviour | ||

| Business Statistics | Personality Development | ||

| Customer Relationship Management | Communication Skills | ||

| Information Technology for Business | Business Law | ||

| Operation Research | Business Environment | ||

| Research Methodology | Basics of Cost Accounting | ||

| Principles of Banking | Innovations in Banking & Insurance | ||

| Human Resource Management | Global Banking & Capital Markets | ||

| Business Communication | Business Planning & Project Management | ||

| Marketing in Banking & Insurance | Creativity & Innovation | ||

| Principles of Insurance | Small Business Management | ||

| Business Information System | Retail Banking | ||

Students will be selected on basis of academic qualification, Group Discussion and Personal interview. Shortlisted students will be notifies through mail or SMS.

Each college has its unique features. But most of the Top Colleges of BBA in Banking and Insurance are accredited by government bodies. Studying from these colleges guarantees good placement opportunities.

| Rank | College/University | Annual Fees (INR) |

|---|---|---|

| 01 | DY Patil university, Pune | 1,20,000 |

| 02 | JECRC University, Rajasthan | 1,10,000 |

| 03 | Sharda University, Noida | 1,59,000 |

| 04 | DIRD, New Delhi | 70,000 |

| 05 | Krupanidhi Degree College, Bangalore | 58,000 |

| 06 | Sri Guru Tegh Bahadur Institute of Management and Information Technology, New Delhi | 55,000 |

| 07 | Guru Gobind Singh Indraprastha University, New Delhi | 65,000 |

| 08 | VIPS, Delhi | 91,300 |

| 09 | Symbiosis University Of Applied Sciences, Indore | - |

| 10 | MSI, Delhi | 88,000 |

| Rank | College/University | Annual Fees (INR) |

|---|---|---|

| 01 | Sharda University, Noida | 1,59,000 |

| 02 | DIRD, New Delhi | 70,000 |

| 03 | Sri Guru Tegh Bahadur Institute of Management and Information Technology, New Delhi | 55,000 |

| 04 | Guru Gobind Singh Indraprastha University, New Delhi | 65,000 |

| 05 | VIPS, Delhi | 91,300 |

| 06 | MSI, Delhi | 88,000 |

| Rank | College/University | Annual Fees (INR) |

|---|---|---|

| 01 | DY Patil university, Pune | 1,20,000 |

| 02 | IMED | 1,00,000 |

| Top BBA in Banking and Insurance Colleges in Bangalore | |||

|---|---|---|---|

| Rank | College/University | Annual Fees (INR) | |

| 01 | Krupanidhi Degree College, Bangalore | 58,000 | |

| 02 | IAGI | 70,000 | |

| 03 | Manipal Academy Of Higher Education | 1,63,000 | |

| 04 | DSU | 1,60,000 | |

*Please note that the fees are subject to change. For further details please call us on 09743277777

There are lot of Scope of BBA in Banking and Insurance. After completion of their studies BBA graduates can find lucrative opportunities in the area of retail, investment, merchant, treasury, etc and in all branches of insurance such as life, property, and medical insurance, etc. They can also go for banking programmes like axis young bankers program, etc

There are different fields from which graduate can choose like:

BBA Banking and Insurance Placement cell facilitates between the corporate and the student for recruitment. The cell develops students who are employable according to corporate requirements. This is done through hours of targeted training which will help them improve confidence levels, analytical thought, presentation delivery, communication skills, and technical know-how.

The department assists students with recruitments and creates opportunities through projects, seminars, guest faculty from various industries, internships, and any other Industry-college partnership.

| Major companies to recruit | |||

|---|---|---|---|

| Concentrix | Wipro | ||

| IBM | Renault | ||

| INNOWAR | TATA consultancy | ||

| HDFC Bank | Reliance | ||

| Fidelity | Royal Bank of Scotland | ||

| Bullmen Realty | Pnb MetLife | ||

| British Airways | Vasundhara Grand | ||

| AXIS Bank | Jet Konnect | ||

| ACCORPLUS | Novus Green | ||

To know more about the Admission Process in BBA Banking and Insurance call us at +91-9743277777